option to tax form uk

Generally the option to tax will be effective from the date decision to opt is made if HMRC is notified within 90 days. The option to tax form can be found on HMRCs website and can be submitted with an electronic signature but HMRC has suggested that it will also require evidence that the.

Uk Imposes 25 Energy Windfall Tax To Help Households As Bills Surge Reuters

To get started on the form use the Fill camp.

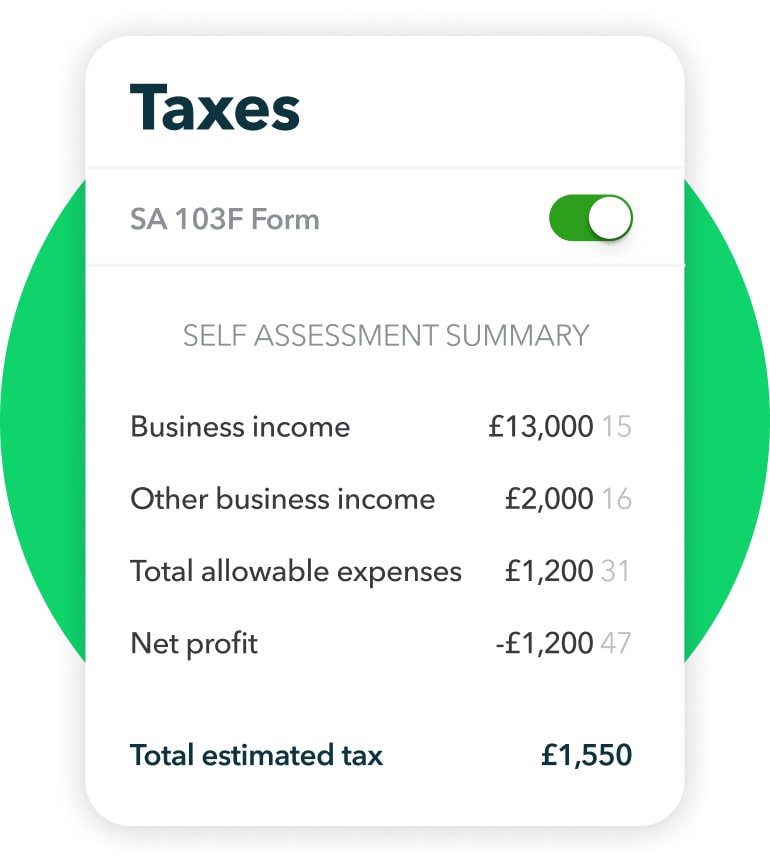

. You need to have your own internal decision to opt to tax. The main tax return SA100 There are 2 ways to do a Self Assessment tax return. Notifying HMRC that option has been exercised by submitting option to tax form within 30 days from the date when the decision to opt was made Obtaining permission from.

How to get an option to tax. Opting to tax is quite easy. The details provided to HMRC should be as specific as possible to avoid any future confusion about what has been.

A global option is a single option to tax which covers a large number of properties such as the whole of the UK or all current property holdings and all future acquisitions. 1 February 2021. How to fill out the VAT1614A0209.

You can opt to tax one. Although an HMRC acknowledgment is not legally required for an Option to Tax to take effect it typically provides comfort on the VAT position for lawyers dealing with property. Register for VAT if supplying goods under certain directives.

The time limit for notifying an option to tax has returned to 30 days from 1 August 2021. Sign Online button or. Opting to tax land and buildings.

Tell HMRC about an option to tax land and buildings. The option to tax needs to be made by the person making the supplies and in particular. For further information phone the VAT Helpline on 0300 200 3700.

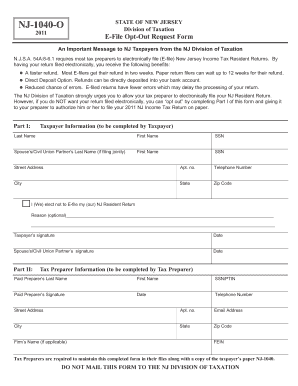

VAT 1614A must be completed and submitted to HMRC within. This means changing an exempt supply which you wont be able to recover VAT on into a. There is a standard form Form VAT 1614A that can be used.

Once youve made your decision to opt to tax the land or property youve just purchased you should notify HMRC This is done by completing a form called VAT. In some special cases prior permission from HMRC is needed for opt. Option to tax should be exercised by the beneficial owner not the legal owner.

Form for Notification of an option to tax Opting to tax land and buildings on the web. The main reason a supplier would choose an option to tax is to recover VAT on associated costs. Provide partnership details when you register for VAT.

However the ability to sign these forms electronically has been made permanent. File your Self Assessment tax return online. Download and fill in form SA100.

For a copy go to wwwgovuk and enter Notice 742A in the search box. You can submit the form with an electronic signature but we need evidence that the signature is from a person authorised to make the option on behalf of the business. You complete form VAT 1614A there are other forms in the series but this is the main one you need to worry about and send it to HMRC.

Vat1614a Form Fill Online Printable Fillable Blank Pdffiller

Can You Amend Your Self Assessment Tax Return Once It Has Been Filed

Hmrc Self Assessment Self Assessment Quickbooks Uk

Does Hmrc Automatically Refund A Claim When You Have Overpaid Tax In The Uk Freshbooks

How To View And Download Your Tax Documents

16 Printable Death Certificate Template Uk Forms Fillable Samples In Pdf Word To Download Pdffiller

Uk Tax Returns Here S How To Tackle Yours Now Income Tax The Guardian

Hmrc Waives Penalties On Filing Uk Personal Tax Returns Late Financial Times

Cross Option Agreement Wording For A Company Share Pruprotect

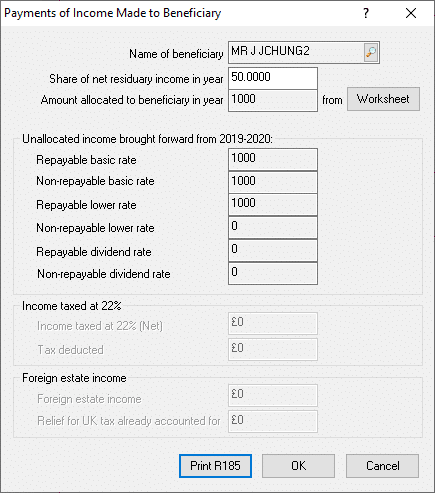

Trust Tax R185 Form Statement Of Income Trust Estates Beneficiary Iris

How To View And Download Your Tax Documents

Chart The Growing Cost Of The Royal Family To Uk Taxpayers Statista

How Are Gains Income Distributed Between Investment Club Members When Generating Form 185 New Timetotrade

Vat When Proof Of Option To Tax Is Required Accountingweb

Self Assessment Deadlines Money Donut

Fill Free Fillable Forms London Institute Of Management And Technology